Libraries Innovate With New Financial Education Programs

In 2007, the American Library Association (ALA); the Reference and User Services Association (RUSA), a division of ALA; and the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation formed a partnership to help public libraries meet the expanding need for unbiased financial education and information in communities nationwide. The program assumed heightened importance when, within a year’s time, market turmoil and the ensuing economic crisis led many Americans to reexamine their financial circumstances. They also began turning to public libraries in larger numbers, recognizing the value of institutions and trained staff devoted to connecting people with helpful and reliable information.

In its first five years, Smart investing@your library® has awarded nearly $6 million in grants and has a network of dozens of grantees representing more than 800 library facilities that reach a service-area population of nearly 27 million.1 In addition to grant funding, participating public libraries and library networks receive training in social media and social marketing, assistance with outcomes-based evaluation techniques, and an introduction to the financial education resources created and supported by the FINRA Foundation. Other program components include communications guidance, individual coaching/consultation, suggestions for building local partnerships, and site visits to review project implementation.

The grantees are encouraged to consult and collaborate with each other and to share resources across participating sites. This collegial environment allows informal mentoring and a mutual support system with opportunities to listen and learn among a broader network of professionals.

Responsiveness to local needs and economic conditions is a hallmark of Smart investing@your library®. The program functions like a laboratory, with the freedom to test new marketing strategies, create partnerships, and experiment with new roles for librarians, who are learning to integrate financial and investor education into an array of traditional and nontraditional library programs and service delivery models.

This article profiles representative programs supported by Smart investing@your library® and highlights innovative approaches to financial education adopted by public librarians.

People of all ages need help managing money, and with the uncertainty about jobs, paying for college, credit and debt issues, and complex decisions about investing, it’s no wonder that librarians are taking a leadership role in financial education. At public libraries across the country, adult services, business, reference, teen, and children’s librarians are stepping up to guide people to resources and programs about budgeting, avoiding scams, investing for retirement, repairing credit, and making informed decisions about managing money. With grants from the FINRA Investor Education Foundation and training from ALA, libraries are experimenting with social media and novel community partnerships that are delivering new relevance to the role of librarians as they incorporate financial education into existing library services.

Partnerships

Partnerships are essential components of Smart investing@your library® projects,and have a decisive impact on project success and sustainability.2 During the planning and proposal development process, grantees must identify partners to collaborate directly on program delivery and indirectly as marketing intermediaries. Libraries have learned from past experience that bonds formed with staff from organizations with a shared mission are likely to be resilient and able to withstand organizational and economic upheaval. In Smart investing@your library®, participating libraries have turned to a vast array of partner organizations—some familiar, others new. For the most part, these have been nonprofit organizations and government agencies. They have not, by and large, been financial services firms, due to restrictions placed on how the grant funds may be used and because Smart investing@your library® has a commitment to financial education experiences that are free from commercial promotions.

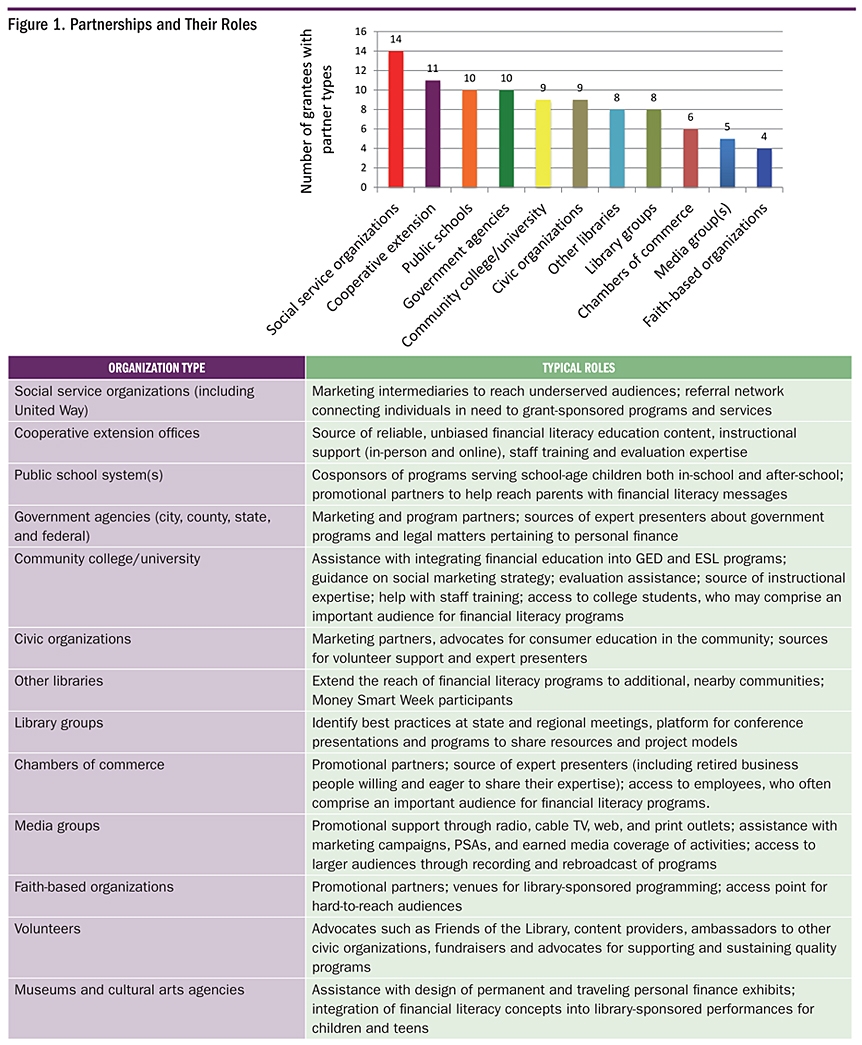

Programs supported by Smart investing@your library® are not about the sales pitch; they’re about connecting people to the best information at times and places that are convenient to them. They are also about making personal finance education accessible in other ways—in a language that library patrons understand, for example, or in a way that’s social and fun or connected to life goals that people have for themselves and those close to them. Good partnerships have helped grantees make all of this possible. Universities and cooperative extension agencies, for example, have stepped forward with first-rate educational content and assistance with program evaluation and staff development. School districts have opened their doors to collaborative arrangements that introduce children and teens to financial literacy basics that will help them with a lifetime of financial decisions. Museums and performing artists have worked with librarians to make financial education hands-on and appealing with narratives that acknowledge people’s emotions and aspirations about money alongside their desire for new skills. Nonprofits serving recent immigrants, language-minority communities, senior citizens, and low-income families have helped libraries deliver programs for the working poor, for older residents coping with the complexities of managing and safeguarding money in retirement, and for those whose primary language is Chinese, Korean, or Spanish. Figure 1 identifies many of the types of organizations enlisted by grantees to make financial literacy programs and services more readily and prominently accessible in communities.

Public libraries can be the local anchor for coordinating, broadening, and strengthening new and existing coalitions of organizations and individuals committed to financial literacy. Libraries’ solid community connections, stature as trusted public institutions, capacity to deliver programs and distribute information to large and diverse audiences, and universal accessibility make them logical partners to support financial literacy programs. The public libraries participating in Smart investing@your library® are stepping into leadership roles by providing staff expertise, up-to-date collections, programming, reference assistance, and deep knowledge of their own communities.

Many grantee libraries have found that by forming an alliance with an existing, well-respected organization, they have gained entrée to their target audiences with greater credibility. In such instances, the partnership has been able to overcome barriers of culture, race, language, distance, and economic conditions that may have precluded successful presentation of programs and information. This has been a common and consistent narrative in Smart investing@your library® as the program has expanded to communities nationwide. The initiative now has a presence in large cities, suburban communities, small towns, and rural areas. Some of these locations are abundant in potential partners; in other locations, an ethos of civic engagement and voluntarism has helped libraries to fashion collaborations that are both creative and enduring. Three examples illustrate some of the ways that public libraries have come together with a variety of nonprofit and government partners to improve financial education opportunities and resources for their constituents.

Ames Public Library Creates a Model for Statewide Expansion

Iowa State University (ISU) Extension and the Iowa Insurance Division worked closely with the Ames (Iowa) Public Library to tailor online and onsite investor education classes for Generation X, Baby Boomers, and the Silent Generation. The program also provided training for public service librarians on the use of investing information tools and databases, and incorporated a social marketing campaign to reinforce important messages about safe investing and wise financial practices. The program used a “sandwich” approach, beginning with a face-to-face session at the library conducted by Iowa State University Extension field specialists. The opening session introduced basic concepts and reviewed a series of web-based courses. Participants then selected one of three online four-week courses: “Starting Out” for Generation X participants, “Building Up” for Baby Boomers, and “Making it Last” for retirees. The online learning was capped by a final face-to-face meeting at the library, again taught by ISU-Extension field specialists with support from librarians.

Building on the experience at Ames, the State Library of Iowa brought the program to scale with a follow-on grant from Smart investing@your library® that expanded the initiative to twenty-five libraries and small towns across the state. The program continues to expand to additional libraries. This has been achieved at modest incremental cost by leveraging the expertise of the three primary partners and using existing educational strategies and marketing materials. Participants in the expanded project achieved measurable improvements in their investment knowledge and gained greater confidence in investing. They also took action to improve their financial circumstances by calculating retirement savings needs and learned how to identify reliable, trustworthy investment information.

OCLS Reaches Hispanic Families and Hospitality Industry Workers

Orange County (Fla.) Library System (OCLS) worked with the Crummer Graduate School of Business at nearby Rollins College to organize a bilingual series on basic investing themes for Hispanic families. The project also provided investor education video-on-demand for library patrons and staff and created a bilingual e-guide on personal finance for users of the library’s website. Early on, the partners agreed it was important to deliver the community-based financial education workshops in Spanish. Six Spanish-speaking MBA students from different countries and cultures were tapped to serve as instructional leaders for the program, under the careful guidance of college faculty and OCLS librarians. Offering these financial literacy workshops in Spanish with the imprimatur of a respected academic institution helped position the library as a credible and trusted resource for unbiased financial information in the community.

The college, in turn, was recognized for its efforts to give back to the community and for meeting local financial education needs. The MBA students came to understand the rewards of public service. The library’s collaboration with Rollins College continues. Together they have reached out to the Hotel Management Association to provide Spanish-language financial education workshops for service workers in the local restaurant and hospitality industry––

a key part of the economy in central Florida––which is home to 114,000 hotel rooms and 450 suppliers to this industry.

Middle Country Makes Financial Education Hands-On and Exciting

Financial educators often emphasize the importance of starting young. Instilling in children the fundamentals of financial literacy will help them make more appropriate financial decisions later in life. Libraries have a great deal of expertise when it comes to children’s programming. Many grantees and their partners in Smart investing@your library® have placed young learners at the center of a common enterprise that is fun, engaging, and important.

Youth services librarians at Middle Country Public Library on Long Island in New York, for example, are enlightening thousands of children about money. Saving and spending, sharing and counting—it’s all included in the “Dollars and $ense: Let’s Learn about Money” exhibit that library staff created with the Long Island Museum. Children visiting the library play the role of bankers and customers, make deposits, practice writing checks, and perform a range of financial transactions. The library has also partnered with the Middle Country School District to integrate the exhibit into schools’ mathematics curricula. Visits to the exhibit—for all third, fourth, and fifth grade classes—have reached 2,300 students. Children experiencehands-on activities incorporated into the exhibit, plus an interactive money management lesson that includes different learning games to reinforce exhibit themes. The project also includes traveling financial literacy exhibits that circulate to other libraries in the area. “The strong partnership with schools and the museum is a critical part of the project,” said project principal Tracy Delgado-La Stella, the library’s coordinator for youth services. “Without the collaboration and support of the schools, the program would not have worked.”3

Partnerships like these are critical to sustaining the financial education activities initiated under Smart investing@your library®. More than 94 percent of grantees report that one or more partnerships will ensure that their project activities are sustained beyond the grant period.4 It helps, too, that Smart investing@your library® has placed considerable emphasis on staff development, which is often made possible by a partnering organization or an agency with relevant content expertise, or by librarians who are particularly skillful in the use of financial reference tools. When the grant ends, this expertise remains, along with updated collections underwritten by grant funds. Patrons continue to benefit from knowledgeable frontline staff members who direct them to appropriate materials, websites, or community resources.

Marketing Moxie

To raise awareness and build capacity, marketing funds are available through Smart investing@your library®. This aspect of the program alone is unusual. Rarely do libraries have dollars specifically allocated to promote individual programs. The program raises marketing to the level of a major goal for every funded project, recognizing that even the very best programs and services are of minimal value if they are not fully subscribed by library patrons.

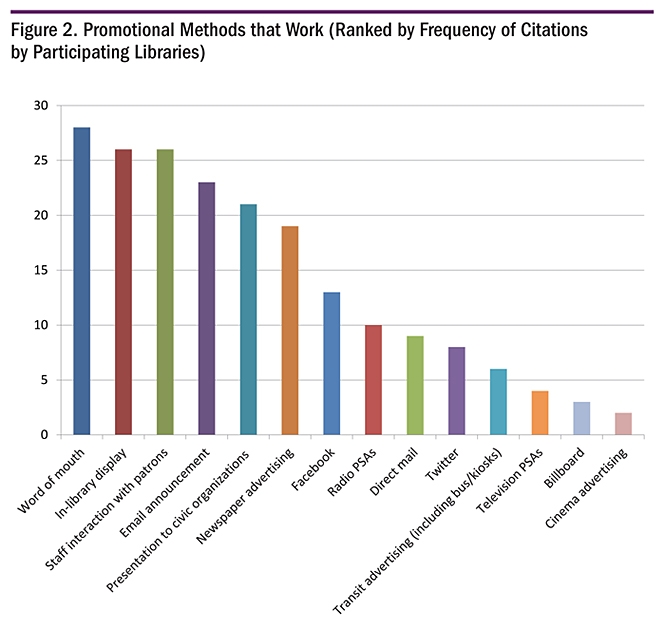

Participating libraries use a variety of data to determine the financial and investor education needs and priorities of their patrons. Point-of-use survey results, reference statistics, interviews with local government officials, and conversations with employers and leaders from community-based organizations are a few examples. Each library crafts a marketing plan with identified objectives that map to their target audiences. This attention to marketing has paid off handsomely, yielding higher visibility for the participating libraries, effective market segmentation, and attention to financial literacy messages and programs. Every local community is unique, and what works well in one media market isn’t necessarily the best option elsewhere. That said, even in this world of social media and online communications, old-fashioned word-of-mouth is still the most promising way to promote activities for many libraries. A well-informed staff is among the best ways to make library users aware of the financial literacy programs and services available to them. Figure 2 illustrates promotional methods that are working in libraries (ranked by frequency of citations by participating libraries).

Schaumburg Township (Ill.) District Library (STDL) and the Greenville County (S.C.) Library System (GCLS) are two libraries that conducted market research to identify their target audiences and then crafted messages that would appeal to them.

STDL’s “Market Research Summary of Millennials, Gen X, and Baby Boomers” is posted on the Smart investing@your library® website. Librarians are welcome to use it as a template to gather data. STDL used skip logic to gather input from all three groups to gauge their financial literacy and develop appropriate programming and marketing messages for each age group. Survey results helped them select a topic for the kickoff event, shape the content for videos aimed at all target audiences, and adjust the focus of a traveling exhibit. They also conducted a survey of library staff to gauge their knowledge level of the library’s investor education resources and their comfort level in referring patrons to them.

GCLS wanted to reach low-income female heads of households ages eighteen to sixty-four, a new and important audience for the library. Research indicated that this demographic would especially benefit from programs addressing financial literacy basics, such as budgeting, understanding bank products, creating an emergency fund, managing credit and debt, and saving for retirement. The project director, Trinity Behrends, noted that this was “a stubborn market segment” made up of “people who had counted themselves out.”5 But she was determined to engage them. With a marketing campaign called “Your Recipe for Success,” the library selected a baking theme and the concept of following recipes to create a non-threatening and welcoming approach to financial topics that previously inspired feelings of dread, nervousness, and indifference (as revealed through participant surveys).

GCLS wanted to transform these anxieties about money into feelings of success and empowerment and draw participants to its financial literacy seminars. The campaign yielded total program attendance in the thousands. Some 86 percent of participants were female, 63 percent were from single-income households, and 45 percent had household income under $35,000.6 By the end of the program, 88 percent of participants indicated that they were very likely to change the way they manage their finances as a result of the educational offerings; 79 percent said the program was very helpful to them in improving their financial capability. Survey research indicated that 91 percent of patrons who attended the in-library seminars followed up with additional personal finance reading using the library’s print and online collections. Taking the campaign to the target audience was critical, and all portions of the marketing mix helped produce audiences for the program. Library staff distributed 12,000 newsletters to grocery stores, created bus ads, posted announcements that were listed on local radio websites and television web calendars, and aired ads on local cable television and other channels (Food Network, Oxygen, and A&E). “Know your audience is a key concept,” said Behrends. “We used ongoing surveys to gauge interest and continually refine our marketing messages and to keep interest high. We learned that marketing should be far enough in advance to allow for word-of-mouth.”

The recipe motif worked so well in Greenville that another grantee library—in Georgetown, South Carolina— adapted the template and rebranded it as “Powerful Investment Education,” or PIE for short. The target audience in Georgetown was invited to a “family financial fitness party” with activities for children while parents talked with government agencies and nonprofit organizations about money issues like credit repair and saving for college. Unlike a lecture series at the library, which can sometimes be intimidating, the family fair attracted parents and children who wanted to enjoy the festivities and get their piece of PIE, both the kind you can eat—dozens were on offer—and the kind to improve your bank account. Greenville and Georgetown achieved similar marketing objectives: to reach people where they are with the financial information that they can put to immediate, practical use.

GCLS and STDL used a combination of marketing strategies to achieve their goals. The same has been true for most grantees in this initiative. Experience with Smart investing@your library® has made clear that libraries have an impressive talent for attracting earned media coverage for their activities. This has boosted marketing campaigns and stretched marketing dollars. The benefits of such coverage can be substantial and long-lasting. For example, the Newton Free Library’s project in Massachusetts, a retirement planning club for women, was featured on National Public Radio’s Weekend Edition in February 2009. More than a year later, library patrons were still making note of the story and asking the project principal how the retirement planning club was coming along. The club remains active.

Marketing plays a starring role in the Milwaukee Public Library’s “Get Smart About Money@MPL” program, which is reaching 6,000 eleventh graders in the public schools. Working closely with its Teen Advisory Board, a local media company, community partners Make a Difference-Wisconsin and Money Smart Week (a program of the Federal Reserve Bank of Chicago), the library created three personal finance videos featuring local teens working with actors. Make a Difference-Wisconsin provides classroom financial education for high school students and uses trained volunteers and a curriculum based on the FDIC’s Money Smart program. These videos—”To Your Credit,” “Check it Out,” and “Bank Your Future”—have a growing presence on YouTube, Facebook, and Twitter, and they have become part of the financial literacy curriculum in the public schools. “Although like many other libraries, we are short-staffed, we found a way we can still make a difference,” said project principal Judy Pinger,the library’s business coordinator. “Strong partnerships with like-minded organizations create the right energy to sustain our program model.”7

Librarians have a new tool to help with marketing campaigns. Prepared by ALA, “The Media Training Guide” is a handy field resource with key concepts and digital-savvy techniques for public relations. Pitching a story and developing a message are just a couple of the practical exercises that help librarians distill their story and get coverage from local media outlets. Participants in Smart investing@your library® have also benefited from “Taking a Blended Approach to PR in a Web 2.0 World,” a webinar about combining social media with traditional media relations to create the optimal mix for building program awareness.8 “The Media Training Guide” and the webinar are available to all libraries at http://smartinvesting.ala.org.

Connecting Library Users with Quality Financial Education Resources

Smart investing@your library® makes reliable, unbiased financial education content readily and meaningfully available to existing and new library users. It’s important to note that this does not mean creating new financial education content. Financial information is available in abundance. Instead, the challenge is helping people make sense of the material, identifying what is most useful for different audience segments, and getting information to people when they need it, how they need it. Librarians participating in Smart investing@your library® are spending their time and talents developing partnerships and marketing strategies rather than creating content. They are also building their knowledge about financial education information sources and their skills in connecting patrons to the best available material and learning experiences. As noted, partners such as nearby universities, cooperative extension offices, and government agencies have assisted libraries with their staff development needs. They have also, along with the FINRA Foundation, connected librarians to best-in-class multimedia information sources.

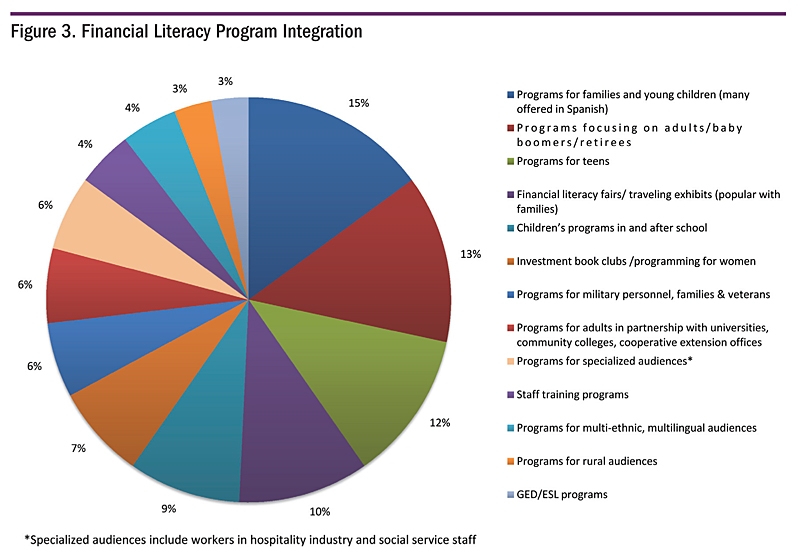

Many of the grantees in Smart investing@your library® have integrated resources and learning opportunities into their well-established programs and services for patrons. Some of these programs and services—those serving small business owners and job seekers, for example, or Volunteer Income Tax Assistance (VITA)—have obvious connections to personal finance. In other instances, libraries have seized the opportunity to add financial education to events and programs where target audiences gather and appreciate the opportunity to learn about money in a way that’s timely and convenient. Estes Valley Library in Estes Park, Colorado, for example, selects entries for its summer film series based on money themes. You can think of it as personal finance entertainment. Screenings are preceded by introductory comments from the library’s consulting financial educator, and viewers discover that the library is an important first stop for learning about money. Figure 3 shows the integration of financial education into existing library programming.

The Public Library of Youngstown and Mahoning County (Ohio) has been among those grantees that combine basic financial education with VITA services. The Youngstown program targets low-income families with young children, in particular. This has been an opportunity to help parents learn strategies to save for their children’s education, or put their financial house in order. The children’s librarians captivate the kids with storytime related to money matters, allowing parents to participate without the worry of arranging child care. Everyone gets a piggy bank to start the whole family on the path to saving and using the library.

The Athens-Clarke County (Ga.) Library (ACCL) created a partnership with the GED program at Athens Area Technical College to incorporate personal finance topics, many of which lend themselves to GED learning objectives, particularly in mathematics. Staff members from both the library and the college were willing to experiment and test whether this approach worked. The recessionary economy led to an enrollment increase in GED programs across the county, making the experiment well worthwhile. Many of the students in the Athens project were unbanked and unfamiliar with or reluctant to use traditional financial services. Among other themes, the program addressed issues pertaining to fringe financial services (payday loans, rent-to-own, title loans, pawn shops, and so on), as well as mainstream financial services, and compared the costs associated with each.

Other financial topics examined by the GED students included: understanding a paystub, creating a budget, credit reports, financial strategies in the event of a job loss, and saving and investing for retirement. Trudi Green, ACCL’s information services coordinator, said, “The success of the classes was due in part to the convenient location for the students. Now our ‘Money Matters’ program has been expanded to other GED programs with course locations at three different sites.”9 The project also branched out to programs for English language learners (ELL) using the same basic model—integrating financial literacy into the existing adult education curriculum. Course ratings for the GED programs have been positive, with 87 percent of participants describing the financial literacy lessons as “very useful.” More than 25 percent of participants had incomes between $10,000 and $25,000. About 45 percent were ages 35 and under, and over 70 percent were women.10

Other grantees have made financial education part of book clubs, summer reading programs, and storytimes for young children, both at library facilities and at daycare centers where the daycare staff themselves have received training. Technology training programs for library patrons have provided librarians with opportunities to demonstrate quality web-based personal finance resources. Grantees have also skillfully integrated information about investor protection and avoiding financial fraud into their outreach efforts serving senior centers and senior residential facilities. All of these strategies represent the collective and creative capacity of public librarians and their partners to make personal finance education into a core library service, and to do so in ways that make sense for patrons.

Many of the programs and strategies comprising Smart investing@your library® are easily adopted or adapted by other public libraries, and they are cost-effective. The grants have all been $100,000 or under and in most cases well under, inclusive of all developmental costs, and have been tested with a great diversity of audiences in a full range of geographic locations. The grantees themselves have been quick to borrow each other’s templates and ideas, and done so with notable success.

ALA and the FINRA Foundation have created a website for Smart investing@your library® with tools and ideas for public libraries to start their own programs. The site has extensive resources that have already been vetted by successful grantees. The site also features downloadable tools, case examples, multimedia materials to publicize programs, survey instruments, staff training templates, and a complete description of participating libraries. It’s a business-to-business site where librarians may borrow freely from virtual shelves and use the materials to create and expand a financial education program.

The FINRA Investor Education Foundation and ALA will announce another round of funding for Smart investing@your library ® in April 2012. The application and more information about dates and eligibility are posted on the Smart investing@your library® website. In June 2012, two program panels comprising past and current grantees will present best practices at the ALA Annual Conference in Anaheim. One panel will discuss marketing strategies; the other will share their experiences developing program partnerships.

References

- Figures extracted from Compare Public Libraries data tool, FY2009 data, available from IMLS website, accessed Nov. 2, 2011.

- Kit Keller, Smart investing@your library® Grant Program Final Report, Nov. 2011.

- Tracy Delgado-La Stella, personal interview with the author, Feb. 7, 2011.

- Keller, Smart investing@your library® Grant Program Final Report.

- Trinity Behrends, personal interview with the author, Apr. 2009.

- Greenville County (S.C.) Library System, final report, July 30, 2010.

- Judy Pinger, telephone interview with the author, Oct. 19, 2011.

- Litlamp Communications Group, “Taking a Blended Approach to PR in a Web 2.0 World” webinar, October 2011, accessed Mar. 27, 2012.

- Trudi Green, telephone interview with the author, Nov. 15, 2011.

- Athens-Clarke County (Ga.) Library Mid-Term Report, May 15, 2010.